- Shanghai Zhongshen International Trade Co., Ltd. - Two decades of trade agency expertise.

- Service Hotline: 139 1787 2118

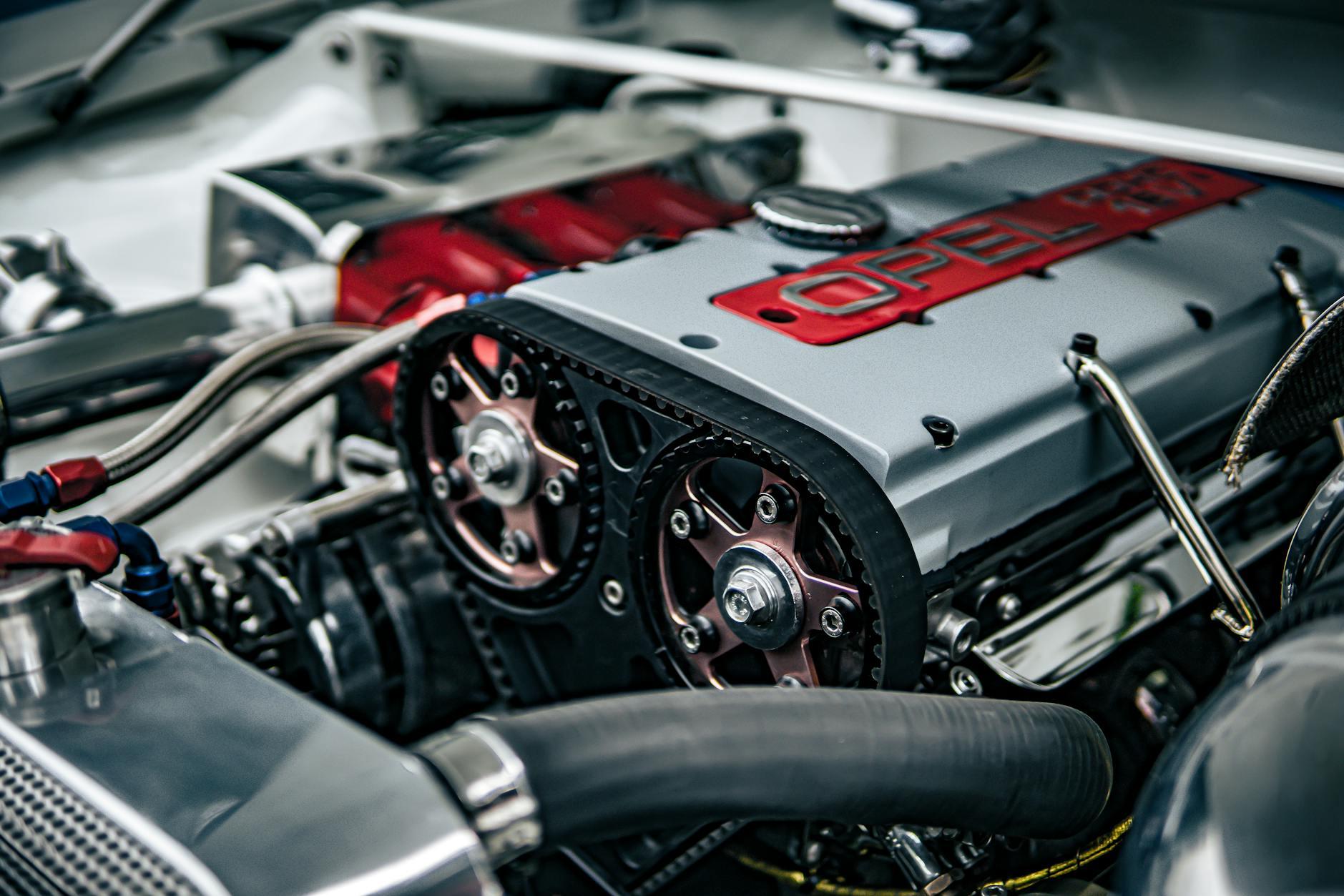

Germany, as a global benchmark in the automotive industry,Automotive partsis renowned for precision manufacturing, technological leadership, and stringent quality standards. For Chinas automotive aftermarket, OEM suppliers, and high-end maintenance enterprises, importing genuine German and OEM parts is a crucial choice for enhancing market competitiveness. As aforeign tradeprofessional agency with 20 years of industry experience, this article will deeply analyze the core processes, potential risks, and practical strategies for German auto parts imports, helping enterprises efficiently complete cross-border procurement.

I. Market Characteristics and Opportunities for German Auto Parts Imports

1.Technical Barriers and Certification Thresholds

The German auto parts supply chain complies with mandatory certification systems such as EU ECE and ISO 16949. Core categories (e.g., engine components, electronic control systems) require TüV test reports or OEM authorization certificates. Importers must clarify applicable regulatory catalogs to avoid customs delays due to missing technical documents.

2.Supply Chain Tiering Characteristics

- Genuine parts (OEM): Must be purchased through brand-authorized channels, requiring verification of suppliers VDA 6.3 (German Automotive Industry Process Standard) qualifications.

- Independent brand parts: Such as Bosch, ZF, and other Tier 1 suppliers, available through distributor networks, with attention to regional distribution policies.

- Remanufactured parts: German environmental regulations impose strict requirements on remanufacturing processes; imports require DIN CERTCO certification.

3.Tariffs and Trade Agreement Dynamics

EU tariffs on Chinese auto parts generally range from 4%-10% (depending on HS codes), but some electromechanical products may face anti-dumping duties. Enterprises are advised to leverage RCEP rules of origin for cost optimization, such as tariff reductions through processing in Malaysia.

II. Key nodes analysis of complete import process

Supplier Qualification Review (Core Risk Control)

- Four Verification Elements:

- Business registration information (via German Chamber of Commerce IHK or Company Register)

- Production licenses (e.g., KBA certification for emission-related components)

- Quality system certificates (IATF 16949 as the automotive industry gold standard)

- Past export records (requiring at least 3 Chinese clients bills of lading and payment proofs)

Trade Terms and Logistics Solution Design

- Incoterms Selection Recommendations:

- Small trial orders: Prioritize DAP (Delivered at Place), with German suppliers bearing main freight and risks.

- Long-term orders: Adopt FCA (Free Carrier at German factory) + self-owned freight forwarder model for cost control and logistics tracking.

- Special Category Transport Requirements:

- Lithium battery parts: Require UN38.3 test reports and MSDS documents; prohibited in fullMaritime Transportation(must be paired withAir TransportationorChina-Europe Railway Express)

- Precision instruments: Require temperature-controlled containers and shockproof packaging, insured with All Risks coverage for transport losses.

Customs clearance compliance management

- Key focus areas of China Customs:

- It is recommended to verify through the following methods:Certificate of Origin (requires EUR.1 or declaration issued by German Chamber of Commerce or notary)

- Certificate of Conformity (COC, proving components comply with Chinese GB standards)

- Environmental compliance (e.g. REACH SVHC test report, RoHS 2.0 certification)

- HS code classification dispute resolution:

Example: Automotive wiring harness with ECU (HS 8544.30 requires ECU function declaration), incorrect classification may lead to 30% deposit penalty.

III. Twenty years of practical experience: Five risk mitigation strategies

1.Supply chain redundancy design

Establish 1 main supplier + 2 backup suppliers system to avoid supply disruption caused by German industrial strikes (e.g. IG Metall union incidents).

2.Preemptive quality dispute handling

Specify in contracts:

- SGS third-party inspection can be initiated within 15 working days after arrival

- Return shipping costs for quality issues to be borne by German party

- Dispute resolution subject to Singapore International Arbitration Centre (SIAC) rules

3.Application of currency hedging tools

Adopt EUR lock-in + forward exchange settlement combination to lock in 80% payment costs during EUR fluctuation periods (e.g. ECB rate hike cycles).

4.Bonded warehouse distribution model

Utilize comprehensive bonded zone policies of batch release, centralized tax payment to store German components in Suzhou, Chongqing and other bonded warehouses, enabling flexible customs clearance based on end orders.

5.Digital traceability system

Require suppliers to embed RFID chips or QR codes to achieve end-to-end traceability from German factories to Chinese warehouses (reference Audi EPL system).

IV. Future trends and agency service upgrade directions

1.New energySurge in component imports

Growing demand for VW MEB platform and BMW i-series related components requires attention to EU Battery Regulations carbon footprint reporting requirements for Chinese importers.

2.German warehouse + China exhibition trade model

Leading agency service providers have established forward warehouses in Duisburg and Hamburg, supporting customers zero-inventory sample procurement and reducing delivery cycles to 7 days.

3.RegTech applications

Use AI systems to automatically capture EU and China customs regulation changes (e.g. EU CSRD reporting requirements) and push real-time compliance alerts.

Conclusion

German auto parts import is not merely a trade activity, but a systematic engineering project involving technical standards, compliance systems and supply chain management. Choosing foreign trade agencies with localized German service capabilities and familiarity with Sino-European regulations will become enterprises core competitiveness for cost control and risk mitigation. In the next three years, as Chinas NEV exports deepen integration with Germanys traditional supply chains, the value of professional agency services will become more prominent.

(Note: Data and policies in this article are updated to Q3 2023. Please refer to latest regulations and contract terms for specific operations.)

Authors Introduction

Specialized in German industrial productsImport RepresentationWith 20 years in the field, we have completed cross-border automotive parts projects exceeding 200 million euros.

Related Recommendations

Contact Form

? 2025. All Rights Reserved. Shanghai ICP No. 2023007705-2  PSB Record: Shanghai No.31011502009912

PSB Record: Shanghai No.31011502009912